All Categories

Featured

Play the waiting game until the residential property has actually been confiscated by the area and sold and the tax obligation sale.

Pursuing excess profits offers some pros and disadvantages as a service. Take into consideration these prior to you add this strategy to your real estate investing arsenal.

There is the possibility that you will certainly gain nothing in the long run. You might shed not only your money (which with any luck will not be quite), yet you'll likewise lose your time too (which, in my mind, is worth a lot more). Waiting to collect on tax sale overages calls for a great deal of resting, waiting, and wishing for results that normally have a 50/50 possibility (typically) of panning out favorably.

Accumulating excess proceeds isn't something you can do in all 50 states. If you have actually already obtained a residential property that you desire to "chance" on with this strategy, you 'd much better wish it's not in the incorrect component of the nation. I'll be honestI haven't spent a great deal of time dabbling in this area of spending because I can't deal with the mind-numbingly slow-moving pace and the full lack of control over the process.

In addition, many states have laws impacting bids that exceed the opening quote. Settlements above the area's benchmark are understood as tax obligation sale overages and can be profitable investments. The details on excess can produce problems if you aren't aware of them.

In this article we inform you exactly how to obtain checklists of tax excess and make money on these possessions. Tax obligation sale excess, also called excess funds or exceptional proposals, are the amounts quote over the beginning rate at a tax obligation public auction. The term refers to the dollars the financier spends when bidding above the opening bid.

This beginning figure mirrors the tax obligations, fees, and passion due. The bidding process begins, and several capitalists drive up the price. Then, you win with a proposal of $50,000. The $40,000 increase over the original quote is the tax sale excess. Claiming tax sale overages means acquiring the excess money paid throughout an auction.

That stated, tax sale overage insurance claims have shared qualities throughout many states. Throughout this duration, previous proprietors and home mortgage holders can call the area and obtain the excess.

If the period expires before any interested events claim the tax obligation sale overage, the area or state typically takes in the funds. Previous proprietors are on a rigorous timeline to claim overages on their properties.

Tax-defaulted Property

, you'll make passion on your entire bid. While this element does not suggest you can declare the overage, it does help minimize your expenses when you bid high.

Bear in mind, it might not be legal in your state, suggesting you're limited to collecting interest on the excess. As mentioned above, an investor can discover methods to benefit from tax obligation sale excess. Due to the fact that passion income can use to your entire proposal and previous owners can declare overages, you can take advantage of your understanding and tools in these scenarios to take full advantage of returns.

A critical aspect to remember with tax sale excess is that in the majority of states, you just require to pay the area 20% of your complete proposal up front., have regulations that go beyond this policy, so once more, study your state regulations.

Rather, you just require 20% of the bid. Nonetheless, if the building doesn't retrieve at the end of the redemption period, you'll require the remaining 80% to acquire the tax obligation act. Because you pay 20% of your quote, you can make rate of interest on an overage without paying the full rate.

Again, if it's lawful in your state and county, you can work with them to help them recover overage funds for an extra cost. You can gather rate of interest on an overage quote and bill a fee to improve the overage claim process for the previous owner.

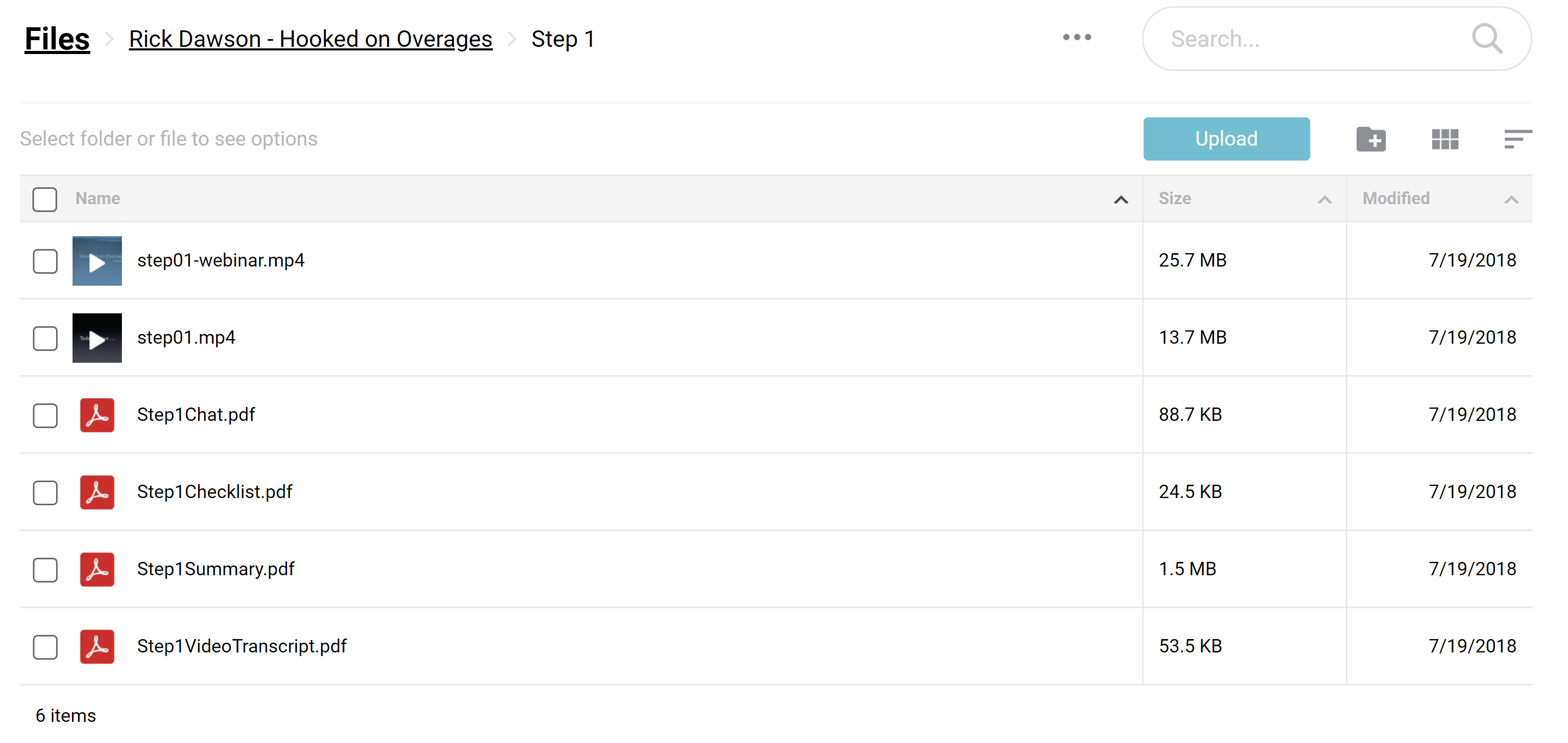

Overage enthusiasts can filter by state, area, residential property kind, minimal overage quantity, and optimum overage amount. When the information has been filtered the collectors can decide if they wish to include the avoid mapped information plan to their leads, and after that pay for just the confirmed leads that were located.

Land With Tax Liens

In addition, just like any other financial investment strategy, it uses distinct pros and disadvantages.

Tax obligation sale excess can develop the basis of your investment design because they offer an affordable means to make money (mortgage foreclosure overages). You do not have to bid on buildings at auction to invest in tax obligation sale excess.

Doing so doesn't cost numerous hundreds of bucks like purchasing numerous tax liens would. Instead, your research study, which may involve miss tracing, would certainly cost a comparatively tiny fee. Any kind of state with an overbid or exceptional quote method for auctions will certainly have tax sale overage chances for capitalists. Remember, some state statutes protect against overage choices for past owners, and this problem is really the subject of a existing Supreme Court situation.

Your sources and approach will certainly figure out the finest environment for tax overage investing. That said, one technique to take is collecting passion on high premiums.

Any public auction or repossession including excess funds is a financial investment chance. You can invest hours researching the previous proprietor of a residential property with excess funds and call them only to discover that they aren't interested in going after the money.

Latest Posts

Tax Sales Overages

States With Tax Deed Sales

Notice Of Tax Sale